“Keep your face to the sunshine and you cannot see the shadow.

It’s what sunflowers do.”

You’re invited to be part of the Sunflower Club

The Sunflower Club is a special group of donors who make a $300 contribution to Lutheran Social Services of the Southwest. Join the club and increase your impact this year!

A gift to Lutheran Social Services of the Southwest goes far towards stabilizing lives of children in foster care and people experiencing homelessness, building foundations for refugees and immigrants, and preserving dignity and respect for older adults and individuals with disabilities.

During this time of challenges and darkness, be a sunflower. Choose to seek the light.

All donors who join the Sunflower Club receive two limited edition LSS-SW Sunflower Club stickers! One for you, and one to share light with a friend.

Read on for Frequently Asked Questions and to find out how you can join the club.

Frequently Asked Questions

Why can I deduct an additional $300 from my federal income tax this year?

Thanks to the CARES Act, charitable gifts up to $300 can be claimed as deductions "above-the-line" when taking the standard deduction. Normally, you have to itemize deductions to have a tax write off for charitable gifts. This year, it's available to people who claim the standard deduction, which is $12,400 for individuals or $24,800 for those married filing jointly. This was accurate for tax years 2020 and 2021.

How can my gift qualify for the Sunflower Club?

Give a one-time gift of $300 to make a big-time difference in the stability of Lutheran Social Services of the Southwest during this time of crisis and transition. You do not need to specificy that your donation is for the Sunflower Club to be recognized. Creating Community Society, Monthly Sustaining Partners, and other special donors are already members of the Sunflower Club.

Which gifts qualify for the $300 deduction?

Any cash gift (including checks and credit card payments) made in the 2020 or 2021 calendar year can be claimed towards the $300 Universal Charitable Deduction.

Can my $300 gift also be used for the Arizona Charitable Tax Credit?

No, you cannot claim the same gift for your Arizona Charitable Tax Credit and for the CARES Act Universal Charitable Deduction.

Can I make gifts for both the $300 deduction and the Arizona Charitable Tax Credit?

Yes! That would make a huge impact on the nonprofit(s) that you choose to support with financial gifts.

Can a couple take a deduction of $600?

The $300 deduction is per tax return, not per individual. If you are filing separately, you can each make a gift of up to $300 and deduct that on your federal income tax. If filing jointly, you can only take up to $300 as an additional deduction.

What do I need to take the deduction?

This is only to use if you take the standard deduction on your federal income taxes. It will be reported as a deduction to your gross income, most likely on Schedule 1 of Form 1040, however, official forms have not yet been released. The IRS does not require any documentation of your donation to be submitted with your taxes, but please keep documentation of the receipt for your records. For any gift under $250, a copy of the cancelled check or bank statement will suffice. If the gift is over $250, the donor must have a written acknowledgement from the organization. All donors to LSS-SW will receive a written acknowledgement letter.

What else does my gift do?

Your gift...

- is the gentle care from a caregiver to an isolated older adult.

- provides safety to a child with disabilities.

- shelters a person experiencing homelessness.

- welcomes refugees to their new home.

Thank you for making your gift to Lutheran Social Services of the Southwest.

Please note, the above information is not intended as official tax advice. Please consult your tax advisor for specific situations.

A client in Southern Arizona enjoys his box of supplemental food

Youth appreciate headphones they can use for online classes

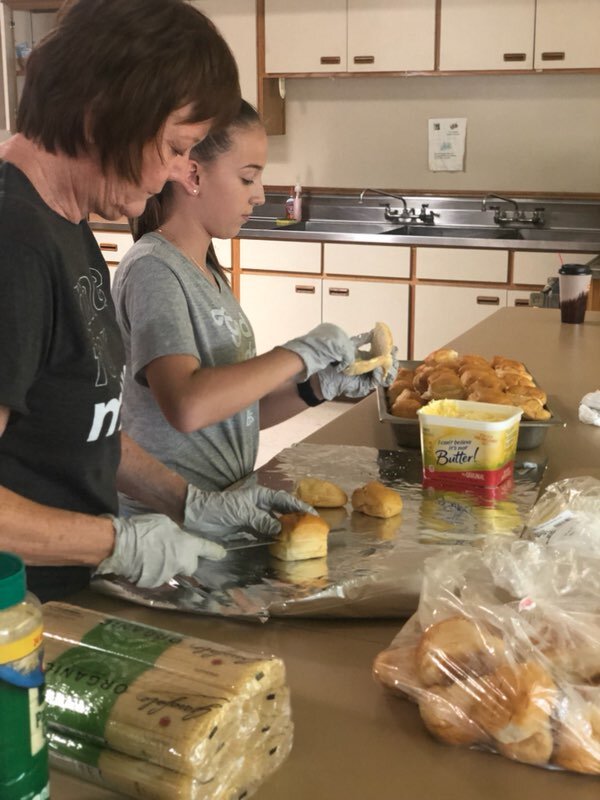

Volunteers turning towards light during a client’s baby shower

For more information, contact donations@lss-sw.org or call (480) 387-5382